Buyer Resources

San Antonio Real Estate

GETTING READY TO BUY

Purchasing a property is probably one of the biggest financial decisions you will ever make. Regardless of whether you are a first time home buyer or experienced investor, you must make careful decisions throughout the buying process. Below are some things to consider before you buy.

Why Are You Buying?Are you tired of paying expensive rent or simply outgrown your current home? Are you looking for an investment property? Having a clear sense of your “why” behind a new purchase will help you evaluate the right factors and choose the best property.

Are You Ready to Invest?Property ownership has been one of the top strategies for building wealth - and still is! Whether it’s your first home and you’re building your first asset, or looking for a rental property, it’s a great time to invest. Property investments are also some of the most stable assets to build and don’t carry the risk like other forms of investment, such as stocks or collectibles.

When you are ready to get started, call us at 210.515.4885 or complete this short form and one of our agents will be in touch.

Get in Touch!

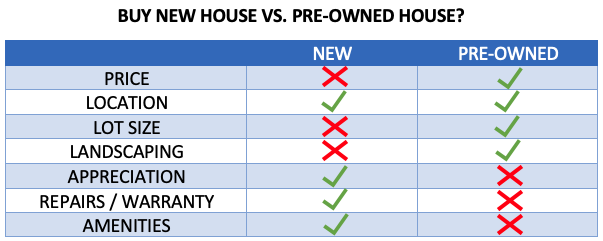

SHOULD I BUY A NEW HOUSE OR A PRE-OWNED HOUSE?"

THE PROS OF NEW HOUSE- Warranties: Most builders offer a “bumper to bumper” one year warranty and ten year structural warranty. You also have the manufacturers’ warranties for appliances, water heater and HVAC system. This can give you a lot of peace of mind.

- Fewer repairs and no remodeling: Since everything is new, you probably will not have to be paying for repairs for the first years. And since everything is new, chances are that you won’t want to do any remodeling.

- Layout: Open concepts are more popular now with larger family rooms instead of both family and formal living room. - larger homes still have both. Some 2 story homes also have a loft or game room upstairs which older homes don’t use to include.

- Amenities: Newer communities often include a pool, trails and/or gym.

- Energy-efficient: New construction techniques include more energy-efficient features like modern appliances, windows and insulation.

- Customizable: When you purchase a new home, you can often customize it to suit your personal needs and preferences. You may be able to choose things like paint colors, types of appliances and whether the house is carpeted or comes with tile or wood floors.

- Resells: All the above pros can make it more appealing during the resell.

- Higher price: Since everything is new you will likely pay a higher price than you would if you chose an older house of equal size and lot size in a comparable location.

- Higher HOA fees: Community amenities like pool, parks, trails and/or gym require upkeep by the homeowners association (HOA). Keep in mind having an HOA can help maintain the value of your home since the community is better maintained.

- More similar homes: New neighborhoods tend to look very similar.

- May have a longer commute: Most available land is outside of the city.

- Limited or no negotiating room: There’s little room for negotiation.

- Little to no landscaping: New homes may require extensive landscaping, which can take a lot of time and money to complete.

- Faster closing time: The average time it takes to buy an existing house is usually faster than purchasing new construction.

- Lower prices: Older homes tend to need a little more TLC than new houses, and they may require major updates.

- Established neighborhoods: Pre-owned homes tend to be located in more established areas.

- If the home was maintained, many repairs have already been made: Some people claim that resale homes are money pits, but you may find houses that have already been updated. Since the house has been lived in for a long time, it’s likely that most major issues have already come up.

- Fully grown shrubs and trees: When you purchase an older property, it’s likely that the home already has mature landscaping and won’t require a ton of time for extensive upkeep.

- More maintenance and repairs: You may need to replace the roof, a new HVAC system or replacing worn carpet.

- Less energy-efficient: A pre-owned home was built with older materials: windows, insulation, etc.

- Older appliances: Usually not stainless steel and with fewer features than the new ones.

- Smaller: The average floor plan size has gradually increased over time. According to data from the Census Bureau, the median single-family home size was 2,333 feet in 2020. In comparison, the average single-family home was 1,525 feet in 1973. Also older homes often come with less storage space, smaller bedrooms, and don’t have a primary bedroom.

- Could contain hazardous materials: Until fairly recently, lead and asbestos were commonly used to construct residential homes.

- A home warranty may not cover replacements: Many people will purchase a home warranty to cover any necessary updates to appliances. But if the previous owner poorly maintained the appliances, your home warranty company may refuse to pay for those updates.

Other things to consider...

Get Your Financials in OrderNow is not a good time to make sudden career changes or large purchases. You want to approach your property purchase from a position of financial stability. Large purchases or loans can affect your credit and balance sheet in a way that can limit your buying options. Your credit score will hold a significant impact on the type of property you can buy, your interest rate and overall property price. We can work with one of our preferred lenders to get an updated credit to know exactly where it stands. The lender will research your credit ratings from the three credit reporting agencies Equifax, Experian and TransUnion. We are happy to recommend seasoned, knowledgeable lenders in the residential, construction, commercial and investment real estate fields.

Organize Your FinancesWhen it’s time to make an offer, you’ll want to know you’re fully prepared to close the deal. In order to avoid delays, bidding wars, or conflicts, preparing your financials is crucial.

- Bank accounts

- Recent pay stubs

- Check Your Credit Rating

- Financial statements

- Investments

- Tax returns for two years

- Credit cards

- Auto and other loans

- Copies of leases for investment properties

- 401K statements, life insurance, stocks, bonds, and mutual account information

Pre-qualifying for a loan will help you with the following:

- Finding the ideal price range you can afford

- Determining what your monthly payment will be

- Understanding the different loans you qualify for

- Estimating the down payment and closing costs

Tips For Buying

Don’t Max Out Your Budget

Just because you’ve been approved for a max amount, doesn't mean you should spend it all on the home's sale price. You will want to set some of that aside for closing costs, taxes and potential home repairs or remodeling.

Get to Know the Area

Make sure the neighborhood works for you and your family - are you close to schools and is shopping conveniently located?

Don’t Skip the Home Inspection

Inspections are worth their weight in gold and will draw attention to problems you may not otherwise see, giving you peace of mind and letting you make more informed decisions about your purchase.

Get Pre-Approved

Getting pre-approved by a lender lets the seller know you are serious and ready to purchase a home and that you are not just window shopping.

Know what you can live with and what you cannot live without and also those things that can be taken care of with a simple remodel. If you need a 4 bedroom home, don't buy one with 2 that requires a massive addition which can break your budget.

Look at the Age of Appliances and Other SystemsAppliances are some of the most expensive portions of the home and you should pay particular attention to their age and whether they have required service. Other systems to have inspected are your HVAC, hot water heater, and your septic & well, if applicable. You may be able to get the seller to add a home warranty when buying.

Check For HOA RequirementsMost neighborhoods have HOAs that govern what you can and can't do - be sure you know what the rules are for your neighborhood.